Correcting E-file Rejection Errors and Recreating the E-file

After an e-file is created and transmitted to the taxing agency, there is always the possibility that it may be rejected by the agency. If one of your Federal or state e-files is rejected, you must correct the errors, re-create the e-file, and re-transmit it. Failure to correct all errors will cause the return to be rejected again.

To fix e-file rejection errors, re-create the e-file and re-transmit it:

- From the menu, select the E-file menu; then, select E-file Manager.

The Status of the e-file is Rejected by Agency.

- Select the check box for the return.

- Click the Fix Errors button.

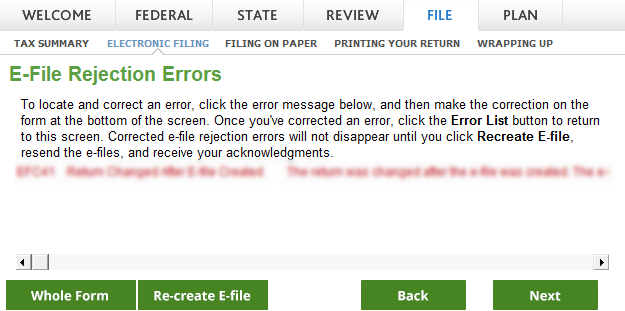

- The Fixing E-file Rejection Errors in Your Return interview opens.

- Click Next.

- Click a specific error (in red) to navigate to the field containing the error.

- Correct the error.

If the error is in a field on a form, the form appears and the cursor is placed in that field.

- Click the Re-create E-file button.

- If the e-file is created successfully, the Sending Your E-files and Checking Status pane appears and you should go to the next step.

- If you have additional errors, the E-file Rejection Errors pane appears again. You must correct all of your red errors to successfully create the e-file. The red Error List button allows you to return to the list of errors.

- Click Send E-file.

The E-file dialog box appears.

- Click Transmit.

- When the transmission state reads Complete at the top of the dialog box, click the Close button.